What Is Fiscal Deficit Class 12

Government budget and the economy important questions for class 12 economics budgetary deficiet and its measures.

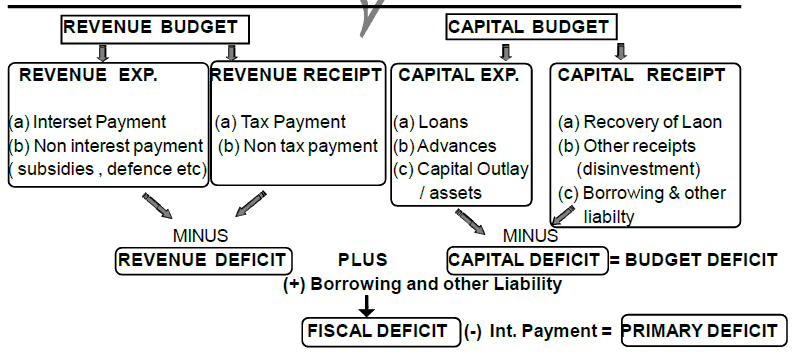

What is fiscal deficit class 12. Generally fiscal deficit takes place either due to revenue deficit or a major hike in capital expenditure. Revenue deficit is the surplus of revenue expenditure over revenue receipts. Fiscal deficit is the difference between the total income of the government total taxes and non debt capital receipts and its total expenditure. Budgetary deficit when a government spends more than it collects by way of revenue it incurs a budgetary deficit i e.

Expected expense expected revenue. For the coming fiscal or financial year. 2 measures of budgetary deficit it includes revenue deficit fiscal deficit and primary deficit. The net fiscal deficit is the gross fiscal deficit less net lending of the central government.

If borrowings and other liabilities are added to the budget deficit we get a revenue deficit b capital deficit c primary deficit d fiscal deficit answer. Give the relationship between the revenue deficit and the fiscal deficit. The fiscal deficit is the excess of budget expenditure over budget receipt other than borrowings. Payment of interest is a revenue expenditure.

It reflects the total government borrowings during a fiscal year. A fiscal deficit. Cbse class 12 economics revision notes macro economics 08 government budget and economy class 12 notes economics budget is a financial statement showing the expected receipt and expenditure of govt. Suppose that for a particular economy investment is equal to 200 government purchases are 150 net taxes that is lump sum taxes minus transfers is 100 and consumption is given by c 100 0 75 y a what is the level of equilibrium income.

Capital expenditure is incurred to create long term assets such as factories buildings and other development.