What Is Conventional Banking

On the other hand conventional banking is an un ethical banking system based on man made laws.

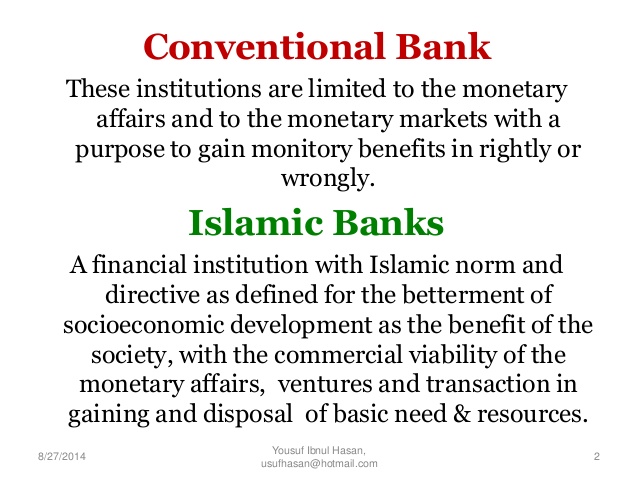

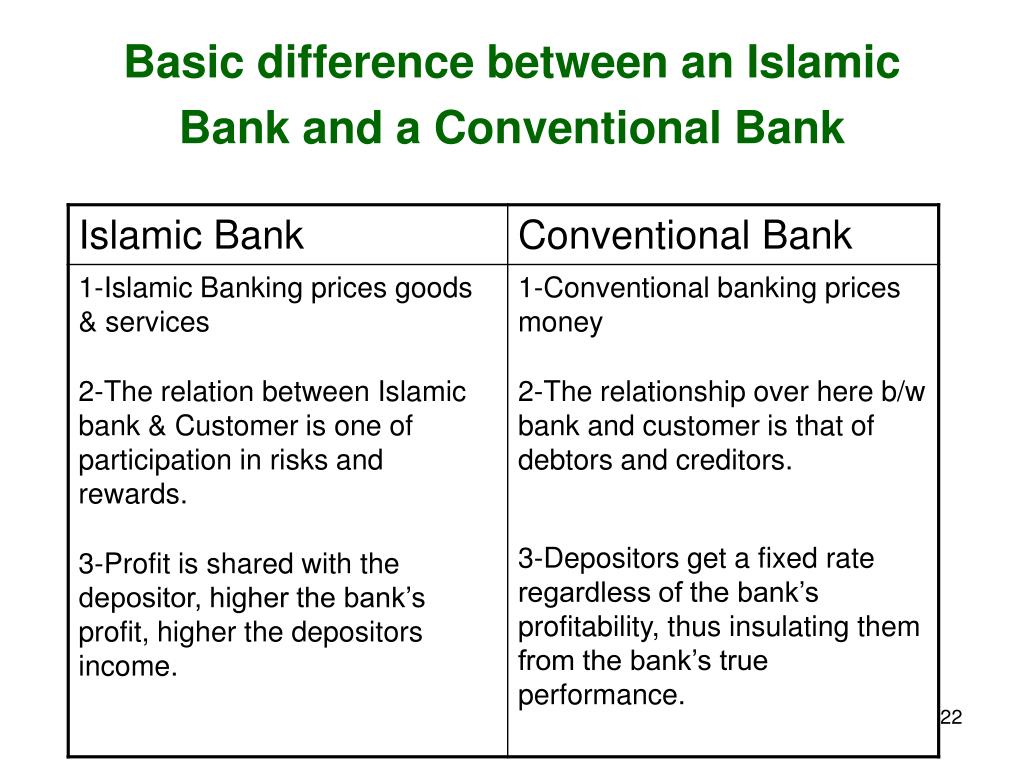

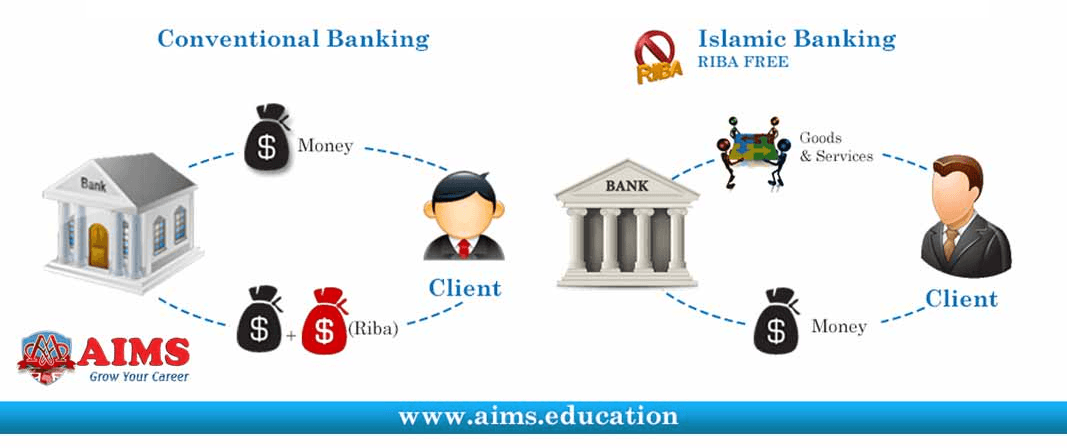

What is conventional banking. Thanks to experience and product selection traditional banks are more advanced. Islamic banking on the other hand uses islamic teachings and syariah laws in their banking products which levy profit rates instead of interest rates. Deposit creation financing refer to section iv agen. Although islamic banking has many products similar to those offered by conventional banking the two entities differ conceptually.

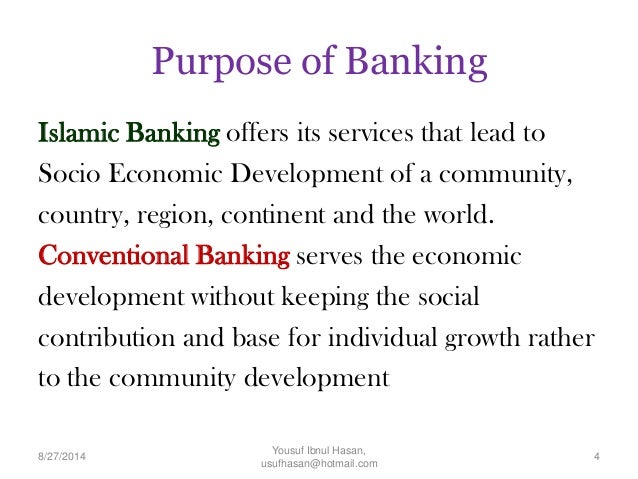

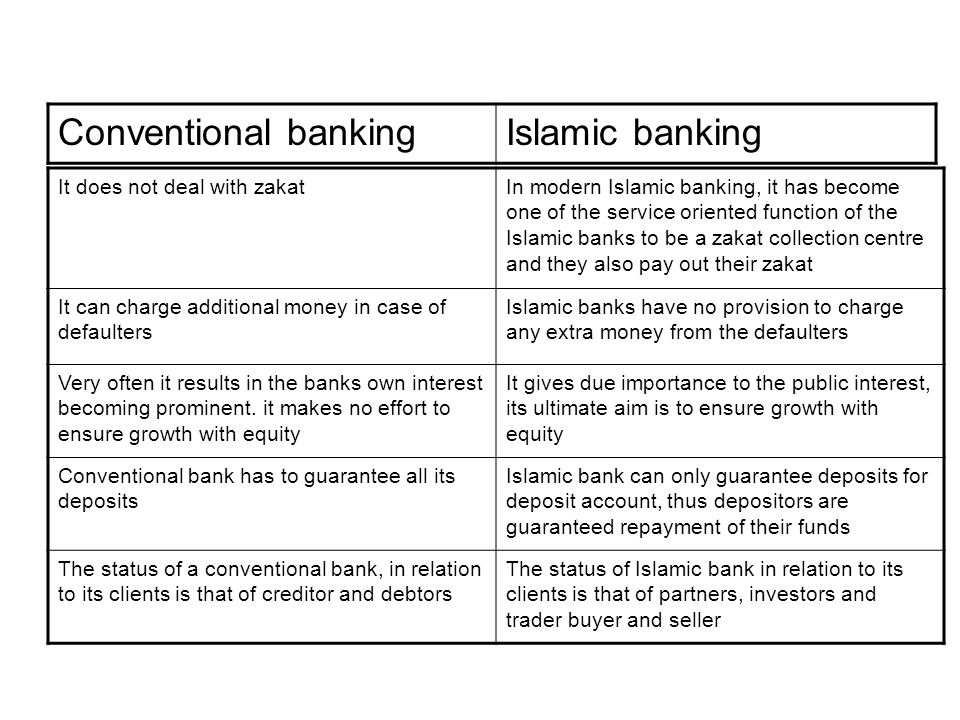

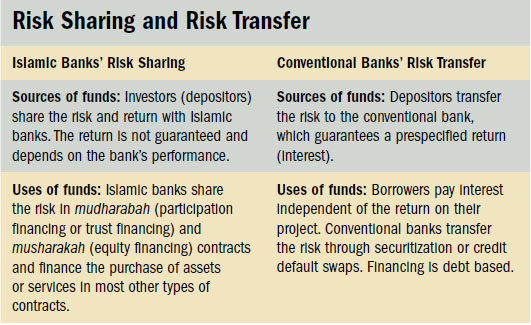

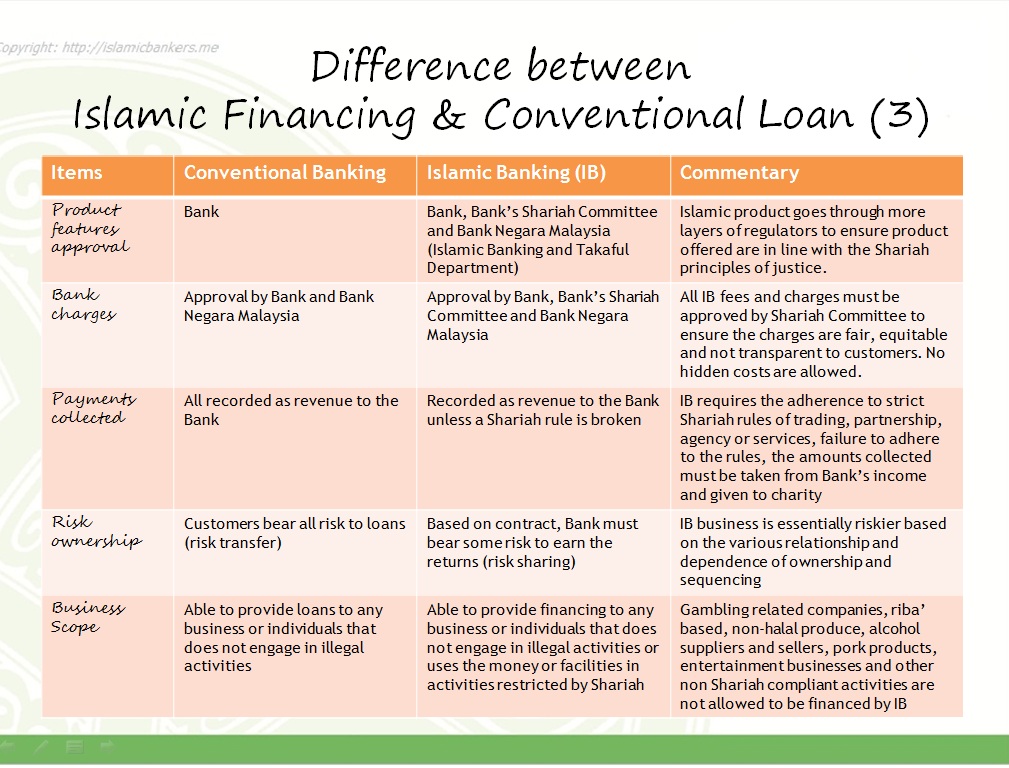

Fundamentally the difference between islamic banking and conventional banking is that the idea fairness to the clients is theoretically focused on the idea of islamic banking itself. On the other hand conventional banking systems are much longer than islamic banks. Difference between islamic and conventional current account. Conventional banks aim to maximize returns and minimize risk.

Islamic banking and conventional banking major differences. In order to be considered a conforming conventional loan the loan must meet the guidelines set by fannie mae and freddie mac. Fannie mae short for the federal national mortgage association and freddie mac short for the federal home loan mortgage corporation are government sponsored enterprises that purchase mortgages from lenders. Islamic banking is a banking system that is based on the principles of.

Conventional banking uses interest charged to lenders along with other investments to turn over an income. After six months the bank has a liability to pay back the customer the principal plus the interest rate charged for six months. Conventional banking loan contracts characteristics. Even if the bank lost the money in an investment the bank is still liable to pay back all the money due.

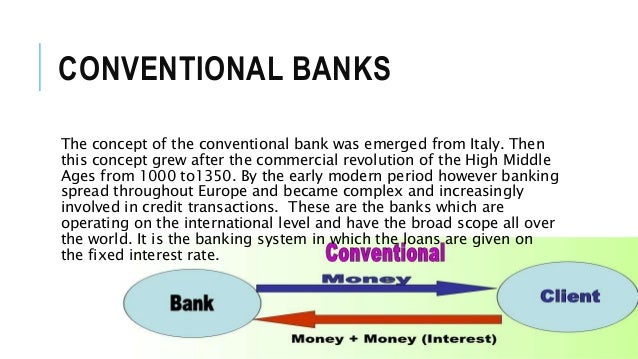

The conventional banking which is interest based performs the following major activities. The conventional bank is based on a full fledged intermediary model that lends borrowers to suppliers and then loans to companies or individuals. It is profit oriented and its purpose is to make money through interest. An islamic window refers to services that are based on islamic principles that are provided by a conventional bank.

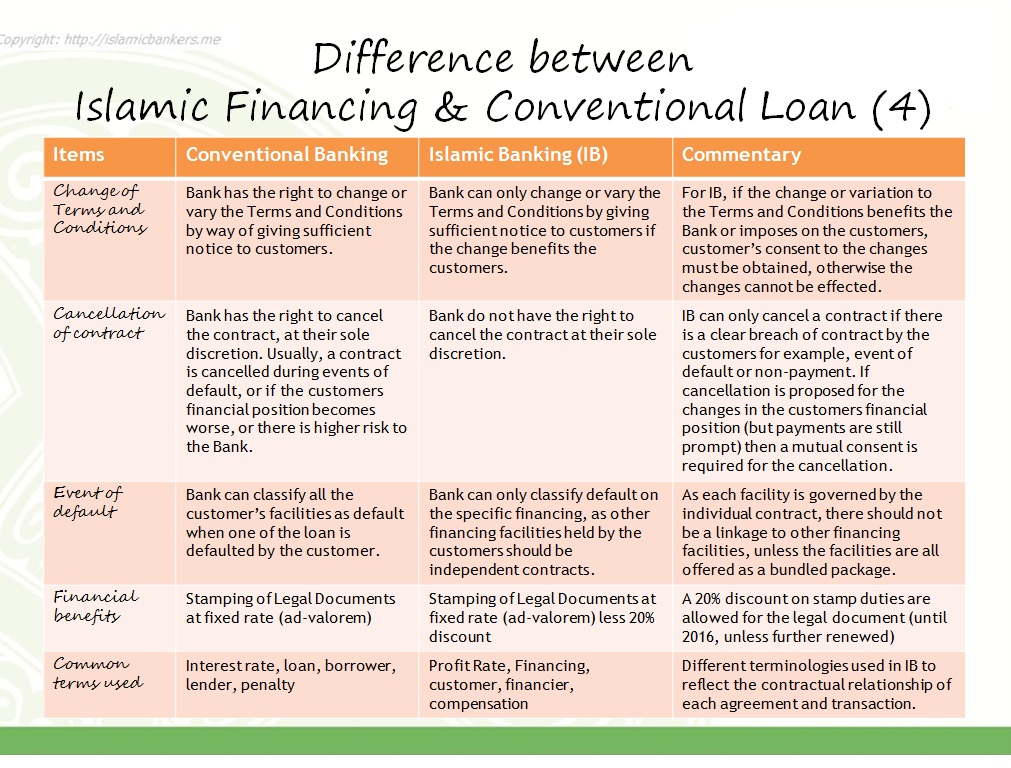

No risk of underlying assets 2. Conventional banks offer lending facilities to their clients to fulfil their cash requirement on the basis of loan contracts where the relationship between the bank and client is that of lender and borrower respectively. Now let us review some major differences between islamic banking and conventional banking systems. For example say that a customer in a conventional bank deposits 10 000 in a six month term deposit.