Stamp Duty For Tenancy Agreement Malaysia 2019

All instruments chargeable with duty and executed by any person in malaysia shall be brought to the collector who shall assess the duty chargeable.

Stamp duty for tenancy agreement malaysia 2019. 2019 stamp duty scale from 1st january 2019 30th june 2019 stamp duty fee 1. How do i calculate the stamp duty payable for the tenancy agreement. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Legal fee for tenancy agreement period of above 3 years.

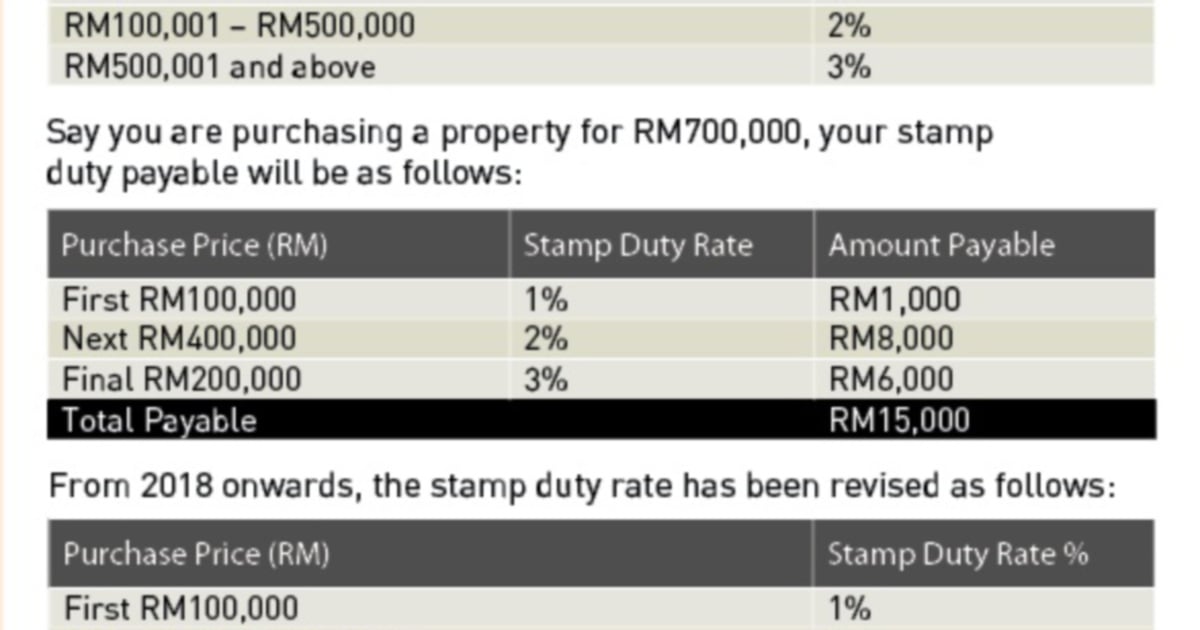

Rm500 billion in debt is the malaysian government bankrupt. In summary the stamp duty is tabulated in the table below. Next rm 90000 rental 20 of the monthly rent. Ringgit malaysia loan agreements generally attract stamp duty at 0 5 however a reduced stamp duty liability of 0 1 is available for rm loan agreements or rm loan instrument without security and repayable on demand or in single bullet repayment.

November 6 2019 july 27 2020 alicia 5 comments rental agreement rental calculator stamping fee tenancy agreement tenant importance of tenancy agreement stamping tenancy agreement i s a printed document that states all the terms and conditions which the tenants and landlords have agreed upon before the tenant moves in. To use this calculator. First rm 10 000 rental 50 of the monthly rent. An instrument is defined as any written document and in general stamp duty is levied on legal.

Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the. More than rm 100 000 negotiable q. Rm100 001 to rm500 000 stamp duty fee 3. How to open trading and cds account for trading in bursa malaysia.

Tenancy period 3 years payable stamp duty rm30 000 rm250 x rm4 120 x rm4 rm480 figures will be rounded up step 4. 2019 27 411 904. The standard stamp duty chargeable for tenancy agreement are as follows. For first rm100 000 stamp duty fee 2.

Sale and purchase agreement malaysia. I got the following table from the lhdn office. Rm24 000 rm2 400 rm21 600. The stamp duty for sale and purchase agreements and loan agreements are determined by the stamp act 1949 and finance act 2018 the latest stamp duty scale will apply to loan agreements dated 1 january 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 july or later.

Rm500 001 and above 2020 stamp duty scale from 1st july 2019. For second copy of tenancy agreement the stamping cost is rm10. For instance the monthly rental for a one year tenancy is rm2 000 so the annual rent is rm24 000. Home calculators tenancy agreement stamp duty calculator.

Total cost involved for tenancy period of 1 year diy tenancy agreement stamp duty stamping for 2nd copy rm120 rm10 rm130. The formula for calculating that stamp duty will be. Tenancy agreement stamp duty calculator.