Rpgt Rate Malaysia 2019

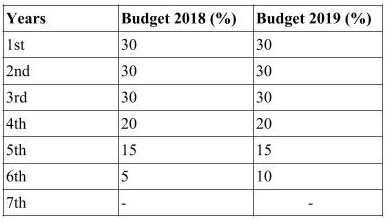

See the tables below for the tax rates.

Rpgt rate malaysia 2019. Selling price purchase price miscellaneous cost enhancement cost miscellaneous cost chargeable gain chargeable gain 10 of chargeable gain not for companies. Now here is some history about the rpgt. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Rm650 000 rm500 000 based on market price on 1st january 2013 rm150 000.

Real property is defined as any land situated in malaysia and any interest option or other right in or over such land. Rpgt payable nett chargeable gain x rpgt rate for example if you bought a house for rm250k and sell it at rm350k the profit of rm100k is chargeable under rpgt but you may be entitled to deduct expenses such as legal fees agency commission and renovation cost with proof of receipt and subject to lembaga hasil dalam negeri lhdn approval in order to get the nett chargeable gain. Learn about malaysia s property stamp duty and real property gains tax rpgt in 2019. First of all the rpgt rate depends on if you are a citizen a non citizen or if it s for a company.

Finally your tax rate will be determined by the holding period which is the number of years you have owned the property. Rm15000 rm7500 rm7500 saving that s a. Rpgt rpgt calculation chargeable gain disposal price. The different rates can be found in the table in question 5.

How will the recent changes in rpgt and stamp duty begin to affect you. It was suspended temporarily in april 2007 to december 2009 and reintroduced in 2010. Now there s about to be another revision to the rpgt for 2020. As you can see from the above example david saved about rm7 500.

It includes both residential and commercial properties estates and empty plot of lands. From 1st of january 2019 onwards the rpgt rates are as below for individuals who are citizens or permanent residents of malaysia. Rpgt rm150 000 x 5 rpgt rate for 6th year onwards rm7500. Fast forward to 2019 the rpgt rates have been revised.

Maximize your returns and minimize costs risks when selling property in malaysia. Rpgt is a tax imposed on gains derived from disposal of properties in malaysia. Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc.